Best and demanding Apps like Klarna will be discussed in this article. People were having financial difficulties, and the Covid-19 pandemic-induced lockdown served as a stimulus for the already rapidly expanding market for BNPL applications. These apps let people make ends meet.

In the present era, when the catastrophic event has been resolved and we are essentially returning to our previous way of life, applications such as Klarna are in high demand. For people who wish to buy something but lack the necessary funds, these apps are a gift from god.

Top Best Apps like Klarna In 2024

In this article, you can know about Apps like Klarna here are the details below;

According to a recent survey, during the COVID-19 outbreak, 60% of respondents used a buy now, pay later service. Additionally, it is estimated that there would be about 60 million BNPL app users worldwide in 2022.

Speaking of which, the business is in for some serious fun even though people appear to adore this. When done correctly, BNPL app development can bring in millions of dollars for you.

This site is for you if that is exactly what you want to do. Everything you require to create a market-leading BNPL app and other applications similar to Klarna that you should check out is covered here.

Thus, having stated that, let’s go straight to it:

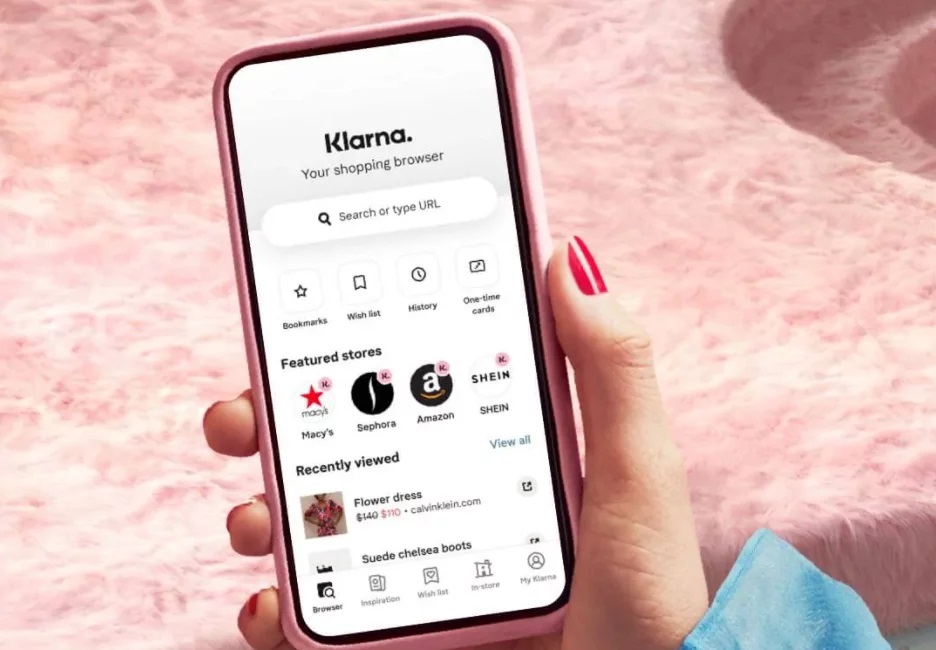

What is Klarna? Buy Now Pay Later App

Klarna has gained notoriety in the last few years. However, what is this platform?

As some of you may have already surmised, Klarna is a well-known Buy Now Pay Later app that is used all over the world. It is a platform owned by Klarna Bank with its headquarters in Sweden.

It is the industry’s best example of a Fintech app development that enables the user to obtain a 30-day soft loan or credit. It is also excellent for shopping because you can add products cart platform will assist you in getting them.

Later on, we will go into more detail about how this platform operates.

In the meantime, you might be surprised to learn that one of Klarna’s investors is well-known American rapper Snoop Dogg. This is one more factor contributing to its growing popularity among customers.

Klarna is especially successful because it was among the first companies to join the market with the option to pay later.

For example, it receives over 40,000 downloads per day. 16 million downloads in total to date. Furthermore, it holds the top spot as the best shopping app in every market where it is accessible.

This demonstrates rather clearly the enormous success this platform has had. Many Americans from all around the country have now been motivated to create their own apps similar to Klarna by this. You’ve come to the correct place if any of these describe you.

However, before getting into the creation phase, let’s examine how these apps function.

How Does Apps Like Klarna Work

Even if Klarna is among the greatest BNPL apps, it differs slightly from the others. The primary goal of this program is to improve and streamline the user’s shopping experience.

That solves the primary problem you face when shopping, which is not having enough money to buy what you want. Simply apply for a soft loan, and you’ll receive the necessary funds in a matter of minutes.

You have the option to repay the loan in full now or over the course of four interest-free payments. This is not the end of the service. This program notifies you as well about incredible discounts on the things you adore.

If you pay back the money on time, you won’t have to pay an additional dollar. It even has an automated mechanism that removes the EMI from your account on its own. You will be assessed a $3 late fee for locations under $100 if you fail to make any of those. Additionally, there is a $7 fee for orders totaling more than $100.

Klarna Payment Options

Now, the fact that Klarna provides a variety of payment methods makes it one of the greatest Buy Now Pay Later apps for bills and shopping. Let us examine these:

- Installments: With this option, the user can divide the total payment into four interest-free installments.

- Financing: The payback amount may be utilised for a maximum of 36 months if you are making larger purchases.

- Payment within 30 days: This platform’s ability to let customers test a product before deciding to buy and retain it is one of its strongest advantages. Klarna is placed in charge of all the hazards.

These are the three distinct approaches that apps such as Klarna provide. Let’s now examine the revenue-generating mechanisms of this platform.

How to Make Money with Apps Like Klarna?

Making money is one of the main goals of launching a company or start-up. Now, monetization methods are necessary if you are developing a mobile app and want to shatter revenue records.

You don’t need to work with specialized developers on this. Instead, you can use your imagination or draw inspiration from other people.

Nevertheless, we’ll be examining a few strategies utilized by well-known BNPL apps, like Klarna, to make money in this section of the blog.

As mentioned below, these are:

1. Transaction Fees

Transaction fees are one of a BNPL application’s main sources of income. Here, users are required to pay tiny, frequently insignificant fees each time they complete a transaction. And this is how the service provider gets paid.

2. Late Fees

The credit you receive is entirely interest-free, as we have already read.

On the other hand, there is a late fee if you don’t pay within the specified window of time. Once more, this is a significant source of income for BNPL systems.

3. Partnership Commission

As we previously noted, the primary goal of apps like Klarna is to make purchasing easier. They collaborate with bigger e-commerce service providers to do this.

By means of this collaboration, they receive a commission. For example, Klarna is one of the best applications for Amazon and other e-commerce sites that allows you to buy now and pay later. Even though it’s not the biggest source of income, it is nonetheless one.

Features to Include When You Develop Klarna App

Any application’s primary motivator is its features, and BNPL development is no exception. As a result, we’ll be talking about a few features that you should think about incorporating into your Klarna app development.

As mentioned below, these are:

RegisterManagement of AccountsOutstanding security alertsAdaptable Repayment

Client AssistanceDeductions made automaticallyBudgeting for the Performance Reward System

Buy Now Pay Later App Development: Step By Step Process

Purchase Now, Pay Later: A Step-by-Step Guide to App Development

It should go without saying that creating a mobile application is a challenging task, especially when it comes to intricate Fintech app development like BNPL.

We will thus be going over the development of the Buy Now Pay Later app to make things easier for you to grasp. These actions are as follows:

1. Ideation

Developing an idea should be your first priority. The adage “every journey begins with a single step” is true. Gathering an idea is the initial stage in this process.

Thus, once you have completed this, we can proceed to the following action, which is

2. Research

An essential component of building a solid foundation for your app is research. And once you get an idea, this is what you’ll be doing.

Additionally, you can carry out a competition analysis and cross-check the concept. You will benefit much from all of this in the future.

3. Hire Fintech Developer

When everything is finished, it’s time to work with mobile app developers.

There are a lot of factors to take into account here. Below, let’s examine a few of them:

- Interaction between the developers and your team

- Their group size

- Historical data and client endorsements

- The development side employs the tech stack.

In addition to this, there is one more item that you must decide on. That constitutes the platform.

As a result, you must decide between app development companies for iOS and Android. Next, you may consider developing hybrid apps.

4. Choose Tech Stack

The tech stack significant impact on how well an app like Klarna performs.

As a result, you ought to pick a tech stack based on how well it suits your business idea and development requirements.

5. UI/UX Design

We will be working on the Klarna clone application’s UI/UX Design in this step.

User engagement and experience are driven by the front-end design. It is therefore suggested that you speak with knowledgeable designers and developers. As a result, the layout ought to be both visually appealing and simple to use.

6. Back-End Development

After front end development is complete, the source code for the application must be written while integrating all of its many parts. Also check Build Meat Delivery App

This is the procedure wherein the final version of the Klarna app is actually built. It takes a lot of time and resources as a result.

7. Testing

It must be tested after development is complete.

One of the most crucial phases in creating a great mobile application is this one. The BNPL app’s final version will be tested for mistakes and problems before being released into the live environment.

Now that this is finished, the app may be released.

8. Deployment

The platform select will have a major impact on the deployment procedure.

Because of this, the deployment procedures for developing native apps and cross-platform apps differ greatly.

9. App Maintenance

This one is a bit different now. This is not a phase that will conclude at some point.

As you can see, app support and maintenance are ongoing activities that occur while the app is operating.

Top 10 BNPL Apps Like Klarna

Let’s take a look at several excellent apps like Klarna that allow you to pay bills and shop online in installments, among other things.

You can get a notion of what to accomplish with your project by looking at some industry-leading BNPL apps.

Having stated that, let’s dive straight in:

1) Affirm

Similar to Klarna, one of the best BNPL apps is Affirm. It was established in 2012 headquartered in San Francisco. Now, the distinctive functionality of this software is what makes it one of the most downloaded ones on the list.

It currently has 7,000 merchant partners and over 10 million users. Because of this, this application is among the main rivals of Klarna.

2) Afterpay

Many people are interested in creating BNPL apps similar to Afterpay.

One of the top buy-now-pay-later apps on the market, similar to Klarna, it is based in Melbourne, Australia. Once more, it boasts over 10 million users and 7,000 retailers.

Once more, this is something you want to give an attempt if you’re searching for Klarna substitutes. Additionally, creating a software like this can enable you to make millions of dollars in revenue.

3) Sezzle

Although this BNPL app isn’t as popular as earlier ones, it has a far larger merchant partner network. As a result, it has more than 2.5 million users but over 30,000 merchants.

The fact that Sizzle is a public-benefit corporation sets it apart. Additionally, it states that it chooses the responsible route and uses the Buy Now and Pay Later option.

It permits the user to repay the money over a minimum of two weeks and a maximum of six weeks, much like other BNPL apps like Klarna.

4) Zip (PreviouslyQuadpay)

Zip is a great illustration of what can be accomplished with the appropriate concept and custom mobile app development services.

The platform, which was once known as Quadpay, demands a basic fare in order for you to divide it among. Speaking of splitting, you can make four equal payments without incurring any additional fees.

Here, obtaining approval is a prerequisite for submitting a credit application. It always includes paying half the total amount up front and the remaining balance over a period of six weeks.

5) GoCardless

The UK-based BNPL platform GoCardless was founded in 2016. It is also one of the largest risks to Klarna, as one might expect.

It currently has over 55,000 merchant partners, most of which are well-known e-commerce sites. This platform is well-known for both its openness and its straightforward UI/UX design. It also has some incredible security features.

6) Sunbit

Even though it’s neither the oldest or most well-known platform on the list, Sunbit has succeeded in becoming well-known.

It delivers some incredible discounts and offers. Furthermore, the application procedure is really easy. This BNPL app’s technology gives retailers access to credits.

Sunbit has the greatest acceptance rate of all the BNPL apps, such as Klarna. This is what distinguishes this as one of the top pay-later options.

7) FuturePay

The US-based business FuturePay, based in Lehi, Utah, approaches the topic in a unique and intriguing way.

Currently, it is quite distinctive since it enables retailers to offer credit for products. Businesses will benefit from this far more. This is actually among the best business apps.

It’s one of the greatest Buy Now Pay Later programs, with all the features you would want in a smartphone app.

8) J2store

One of the biggest BNPL platforms in Asia is J2Store, which is situated in India. Customers adore how simple the setup procedure is and how flexible the payment options are. Also check Wholesale marketing strategy

It contains plugins and is compatible with over 75 payment gateways. It is the greatest choice for e-commerce websites because of this. You can use this as a useful example to provide to your Fintech app development firm.

9) Splitit

This one’s name pretty much tells it all. There is no better way to use Splitit than any other product on the list. In addition, if you are making larger purchases, you can choose to repay over the course of 24 payments.

On the other hand, the application process is simple and there are no late penalties, just like on other platforms.

10) PayPal Credit

A website known as Bill Me Later once existed. It was purchased by PayPal in 2008 and relaunched as PayPal Credit following an incredible performance.

PayPal Credit is a world-class eWallet app development example, demonstrating the potential this technology may have for businesses. Consequently, something to think about.

Develop Your Own App Like Klarna

You should have a clear understanding of why Buy Now Pay Later apps are so well-liked after reading this blog. Apps like Klarna are not only well-liked but have also been making millions or even billions of dollars in income.

This increases the allure of developing an app similar to Klarna. All you have to do to do this is get in touch with a top mobile app development business in the industry. You can make the next great BNPL app available on the market if you have the correct idea, development partner, and assistance.

Add Comment