Best Fido Alternatives will be described in this article. Fido is a web-based marketplace that can provide users with extensive mobile management capabilities, including real-time data tracking, secure on-the-go payments, and bill viewing and printing. This platform lets its clients get Data Overage Protection; the app pauses data usage upon reaching the limit, eliminating unexpected costs.

It can even permit its customers to benefit from five hours of unlimited monthly data at no extra cost, enhancing their digital experience. Fido also comes with the Roam function that allows users to utilize their plan’s data, talk, and text in hundreds of destinations at a low daily fee. There is even availability to offer weekly perks with Fido XTRA, which provides access to deals, contests, and giveaways exclusive to Fido postpaid plan subscribers.

Features

- Quick micro-loans for short-term needs

- Instant loan approval for immediate needs

- Offers flexible & personalized repayment plans

- Secure transactions with robust data encryption

- A User-friendly interface simplifies the loan application process

Pros

- Fast micro-loans

- Secure transactions

- Instant loan approval

- User-friendly interface

- Flexible repayment plans

Cons

- High-interest rates

- Limited loan amount

- Strict approval criteria

Top 10 Best Fido Alternatives In 2023

In this article, you can know about Fido Alternatives here are the details below;

1. PalmPay

PalmPay deals with a massive platform where users can collaborate with a user-friendly financial app trusted by millions in Nigeria for quick money transfers, bill payments, and savings, with a 16% p.a. interest rate. This platform lets its clients get numerous benefits, such as multiple monthly free transfers, discounts on airtime and data, and rewards for new users and referrals. It can even permit its customers to access payments at hundreds of thousands of local shops and provides 24/7 customer.

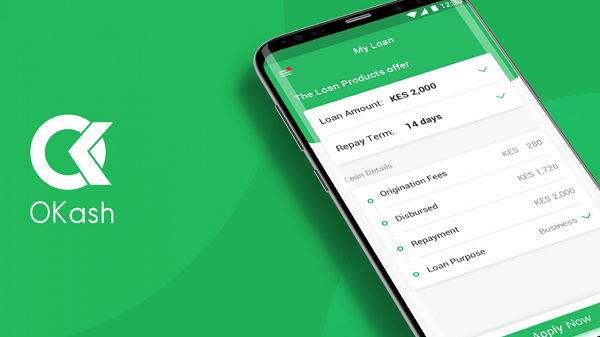

2. Okash

OKash, presented by Blue Ridge Microfinance Bank Limited & licensed by the Central Bank of Nigeria, refers to the platform offering users with a personal loan place offering Nigerians access to loans from NGN 3,000 to NGN 500,000 with repayment terms from 91 to 365 days and an APR from 36.5% to 360%. This platform lets its clients get the entire loan application process quickly, including account registration, product selection, information submission, and agreement e-signing, which can be done through.

3. JuanHand

JuanHand is one of the leading platforms that can provide users with a unique Fintech place in the Philippines; it offers a simple and quick process for cash loans ranging from PHP 2,000 to PHP 25,000, with loan terms from 91 to 180 days and a maximum APR of 30%. This platform lets its clients get online loan application process requires a government-issued ID and proof of stable income for Filipino citizens aged 18 and above. Also check Apps Like iWebtv

4. Ring Loan App

Ring Loan App, backed by RBI-registered NBFC Si Creva Capital Services Pvt. Ltd., refers to the platform offering users a digital payments app by Kissht, enabling them to transfer money and make payments both online and offline at zero interest within a specific time. This platform lets its clients get aimed at millennials; it rewards transactions and offers benefits like loans, insurance, and investments, fostering credit profile building. It can even permit customers to access a vast merchant network. This is another Fido Alternatives.

5. Digido

Digido, part of Singapore-based Robocash Group, is an online platform providing users with a financial services place that provides inclusive lending solutions for underbanked consumers in the Philippines through its mobile app and website. This platform lets its clients get powered by robotic technologies and offers automated applications, credit scoring, and disbursement processes. It can even permit its customers to access an online store, allows browsing, comparing, and ordering from a wide range of products, facilitating cashless transactions. This is another Fido Alternatives.

6. Finbro

Finbro deals with a comprehensive platform allowing users to collaborate with a Philippines-based online lending place providing quick and convenient loans ranging from PHP 1,000 to PHP 50,000 with up to 12-month repayment terms. This platform lets thousands of clients get access through any mobile device or computer, and loans can be applied for by submitting basic information along with one valid ID and a selfie. It can even permit its customers to access loan applications that are reviewed swiftly. This is another Fido Alternatives. Also check Apps like Yik Yak

7. Flypay

Flypay refers to the marketplace offering users a convenient online payment service with a rewarding shopping experience. This platform lets thousands of clients quickly pay for purchases at participating retailers while simultaneously earning points. It can even permit its customers to access the sign-up process for free, link their payment cards, and save their payment and address details for future transactions. Flypay also accepts multiple stores, including Liquorland, First Choice Liquor, and Coles Online, where customers can redeem their points. This is another Fido Alternatives.

8. BillEase

BillEase deals with a massive platform where users can collaborate with a financial service by First Digital Finance Corporation that offers on-demand consumer credit for personal loans, e-wallet top-ups, and buy now, pay later plans in the Philippines. This platform lets its clients pay for their purchases in interest-free or interest-bearing installments at thousands of online and offline merchants. It can even permit its customers to access lower interest rates than cash loans or credit cards, starting at 3.49% monthly.

9. FairMoney

FairMoney refers to the platform that can provide its users with the leading mobile bank in emerging markets. It offers digital financial services, including digital loans, investment products, and savings via its mobile app in Nigeria and India. This platform lets its clients collaborate with tens of millions of consumers, and it is the most downloaded fintech app in Nigeria and is also expanding in India. It can even permit its customers to access nearly tens of thousands of daily. This is another Fido Alternatives.

10. Aella App

Aella App is one of the leading platforms that can provide users with a fintech company offering various financial products like loans, investments, bill payments, micro-insurance plans, and money transfers in emerging markets. This platform lets its clients get a flagship service, which provides easy access to loans ranging from ₦2,000 to ₦1,500,000 with interest rates between 2% – 20% per month and the option for early repayment with discounts. This is another Fido Alternatives.

Add Comment