This post will explain best Profiteer Alternatives. Accounting can appear like a time-consuming task for entrepreneur who have their eyes set mostly on growing their organization. Small businesses need to monitor their cash flows to evaluate the short and medium-term profitability. Specifically for those businesses who are trying to find avenues to scale rapidly. Tax responsibilities are a crucial location which business should consider to be all set for.

Top 14 Profiteer Alternatives In 2023

In this article, you can know about best Profiteer Alternatives here are the details below;

Hence accounting tools assist these companies manage their finances effortlessly and prepare them to face the tax season. Businesses ought to know the key elements they ought to look for in their accounting software. For instance- A style e-commerce start-up may want to keep their dealings with their consumers really expert and elegant. In that case, Custom made in-voicing could be one of the primary accounting requirements. There are numerous kinds of software available with various energy and rate points. The following parameters assist decide which accounting software to select. Also check Supply chain management software

– Type of Industry

– Variety of workers

– The scale of service and everyday transactions

– Size of clients

The essential decision-making areas for company owner prior to acquiring software are as follows:-.

– Determining the real requirements of business and what are the functions that are required for service. The profitability and day to day expenses require to be kept an eye on.

– Planning budget plan– Designate a certain portion of the expense in getting the best tools possible so that the business tracking is done seamlessly.

– Always consult the experts before choosing as they will assist you weigh the benefits and drawbacks. There is constantly a remote opportunity that you might end up spending more than your company requires.

– Select a sustainable alternative to prevent a lot of switches as your company grows.

Let us explore a list of favored accounting tools that will assist you handle your accounting and financial requirements perfectly.

Let us check out a list of popular accounting tools that will help you manage your accounting and financial needs flawlessly.

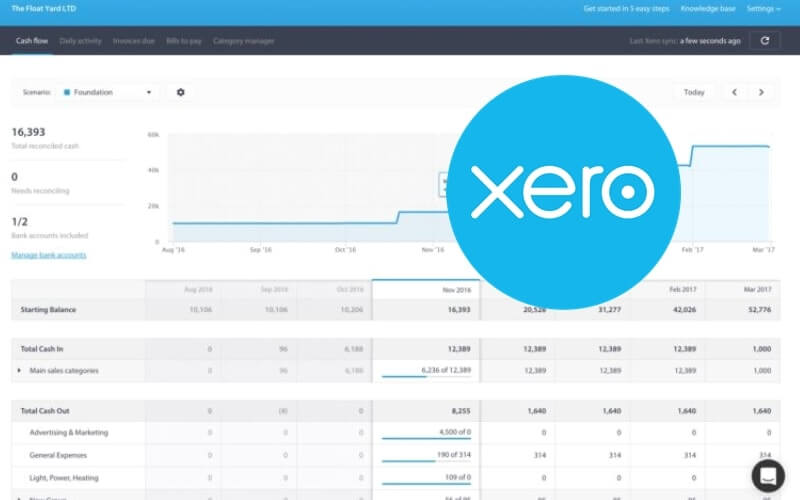

1. Xero.

This is a cloud-based tool that is outstanding for micro-business owners. It Is simple to comprehend and use.

– It helps start-ups with beneficial tools like Online invoicing, Xero control panel to get a current view of the cash flows and to comprehend business better. Its mobile app makes it simple to monitor the monetary health of your growing start-up on the go.

– If you run an e-commerce or an online retail site, this allows you to connect to third-party apps and incorporate to the POS systems, control stock, handle stock and streamline admin jobs.

– For international small companies, it permits a worldwide reach with a high degree of security.

Xero supplies memberships for 3 months and the plans are developed according to the scale of use by the company.

2. FreshBooks.

This is perfect for service-based services and serves as a crucial tool for invoicing. It assists to produce professional invoices and helps companies to manage costs on the go. The very best feature supplied by FreshBooks is enormous scope for customization compared to other apps. In addition to invoicing options, it also helps companies manage their bookkeeping successfully. They supply a 30-day complimentary trial. The following functions assist to monitor important monetary specifications.

– Building a pipeline for late payment of costs.

– Production of Repeating profile for automated dispensation of billings.

– Setting up a billing schedule to manage Auto-Bills.

– Late payment suggestions to the clients to help you manage the scenarios with minimum conflict.

3. QuickBooks.

This is a top selection software for freelancers and specialists who work individually. This helps them find out their earnings and expenditure and offers a good way to understand about their tax returns. The very best function that the app provides is the distinction between organization and individual expenditures. However restricted invoicing functionality and personalization make it ideal only for the previously mentioned target groups who are willing to look beyond this performance. Summing up the advantages, the following are the crucial highlights.

– Immediate payable billings and helps you accept credit and debit cards online.

– Contactless, on-the-go, in-person payments made flawlessly.

– If you have an e-commerce set-up, it assists to process the payment and records deals, calculates sales tax, and produces a receipt.

– Enhances all sort of app combinations important to run your organization.

4. Zoho Books.

It is a cloud based accounting solution that is ideal for small to mid-sized companies. It supplies avenues for the following features.

– Numerous time sheets of various organizations.

– Organizations can link bank and credit card accounts.

– Automate repeating activities such as costs payments, suggestions, and auto-debits.

5. Simplycost.

It allows entrepreneur to add cost prices and earnings tracking and requires to be utilized with their Shopify store. The reports are easy to use to check out and understand. The app supplies filters to break the success reports according to days, months, suppliers, and orders. It was ranked amongst the very best Shopify apps The following are the primary highlight of this accounting tool:-.

– Automatic calculation of earnings and report generation.

– Expenditure tracking and reporting.

– Assists you minimize the amount of time you spend on computing the Cost of Product Sold. Thus it assists you focus on more considerable jobs.

– Assists you view revenues and take service decisions appropriately.

6. Accounting Seed.

Accounting Seed is a cloud based accounting system that supplies safe and secure APIs essential for your organization. It deals with your service to incorporate all the important platforms like bank accounts, vendor market, and so on. The following are the highlights of the usage of this accounting tool.

– This assists you customize your workflows.

– Automates the menial everyday tasks.

– Provides end-to-end visibility on your information and eliminates the silos thus enabling you to see the full image.

– They supply automatic basic journals, accounts payable, monetary reporting, etc – They supply enhanced control panels for much better representation of data.

7. ZipBooks.

The most significant USP of GoDaddy Bookkeeping is that it supplies an economical service and helps to integrate and import information from high authority websites like Amazon, Etsy, and eBay. If you particularly purchase from these sites discussed, this is an extremely inexpensive choice. It assists you to compute the tax estimates quarterly. Nevertheless, it doesn’t dive much into program management, comprehensive reporting, or global billing capabilities. The following are the essential highlights:-.

– It removes the requirement to follow up with its invoicing features.

– Automates sales and cost tracking.

– Provides tailored and professional-looking billings.

8. GoDaddy Accounting.

The most significant USP of GoDaddy Accounting is that it provides an economical solution and assists to integrate & import data from high authority websites like Amazon, Etsy, and eBay. If you specifically purchase from these websites mentioned, this is a very low-cost option. It assists you to calculate the tax estimates quarterly. Nevertheless, it doesn’t delve much into program management, extensive reporting, or global billing capabilities. The following are the essential highlights:-.

– It eliminates the requirement to follow up with its invoicing functions.

– Automates sales and expenditure tracking.

– Provides tailored and professional-looking billings.

9. Kashoo.

Kashoo helps to handle your information and methodically arranges it into classifications for you to read and evaluate easily. Some essential insights are as follows:.

– OCR technology assists to scan and produce a digital copy of the invoice.

– Smart notifications let you know when your customer sends you a payment.

– The billing creator lets the user produce customized billings.

– Real-time info about clients and which are the top-performing clients in terms of clearing the fees.

10. OnPay.

This is a comprehensive payroll solution which not only assists in accounting however likewise in handling complete worker info. The reports can be easily customized and shown which is customizable too. The following are the crucial takeaway:-. Also check best scheduling app

– Automated tax filings & payments with high precision.

– Pays workers through different modes of payments.

– Integrates quickly with other accounting software.

– Account migration and set-up.

11. Wave.

With this awesome accounting tool, you can connect to different bank accounts, classify your overhead, and balance book deals. It is perfect for service-based small companies and freelancers. Anybody who is glancing for a totally free service and doesn’t wish to compromise on the functions can select this tool.

– It is easy and reputable.

– Easily handles capital.

– Instinctive recommendations.

12. Sunrise .

It has self-service strategies. It lets users connect their banks, carry out double-entry accounting and accept payments seamlessly. It has wise insights to assist you take much better business choices. It also qualifies you for the tax season. It is perfect for the following.

– Small company owners focused only on accounting and invoicing.

– Entrepreneurs who need support with accounting.

– Instinctive tax estimator.

– Integration with payroll application together with easy tracking.

13. Tsheets.

Tsheets are presented by Quickbooks. This is a tool that will match the existing accounting tool used mostly to deal with expenditures and profitability. It is a time tracking accounting tool that is important for small businesses. With this tool, business proprietors can track the timesheets of the staff members very quickly. It easily incorporates with unique accounting applications like Quickbooks & Xero. Thus your time-sheet can be easily sent to the accounting software. The essential highlights are as follows:-.

– The app is instinctive and if employees alter their shift, they receive notifications.

– Easy to track and manage.

– Particular tasks, projects, and jobs can be designated minimizing confusion and enhancing worker accountability.

– Assists to maximize efficiency.

14. Expensify.

Recording expenses can be laborious and recurring for business owners. This tool assists you to take a picture of the essential receipts and categorize expenses into crucial containers. It codes and provides the last report for you to simply approve. The following are the crucial highlights:-.

– Helps to reimburse worker’s expenditures.

– Business owners get an user-friendly practical tool that speeds up the procedure of tracking costs.

– Helps to import Business card transactions.

– Produce approval of workflows to fit your business structure.

– Helps beforehand tax tracking, auditing, and compliance.

You must choose the best tool and the right plan to invest sensibly. You must carefully assess your needs and make certain you are not taking in more features than you will use in your service. With time your accounting needs will alter. This implies that you may require to either update your membership to generate more features or switch to another tool that supplies enhanced features. It is likewise advised to purchase a tool that is adaptable to your service development and the associated needs. This will save time. Excluding your familiarity with the tool will help you avoid a short hiatus in getting your tools in place prior to you start your accounting activities. The decision ought to be made after meticulous analysis of business needs, and evaluation of the due diligence. Bottom line is that as an entrepreneur you need to understand what you are paying for.

Add Comment