At the best of times, we all benefit from saving money. However, the need to save money increases when you lose work or find yourself with a reduced income. There is certainly a greater challenge to balancing expenses during these periods.

However, it is not impossible to manage your expenses if you have a good strategy to implement. You need to start putting some money aside each month, even if this is just a small amount, to create a better long-term plan for financial independence. Here, we look at the top ways to save money for low income households.

1. Get a Plan Of Action

By this, we mean you need to start budgeting. Yes, they are boring and can be confusing, but without a cohesive budget, you will have no idea how much money you could potentially save.

Once you have a grasp on your current outgoings and hopefully identified any leaks, you can begin to start working towards a realistic savings goal. Something to understand here is, being on a lower income, you are not likely to have much money to put aside.

Understanding that if this is just a nominal amount you put aside each week or month, start with this. You need to pick a number and stick with this though, even if it is just £10. Having this as a building block will get you into the mindset of saving and focusing on a figure will discipline you when this figure eventually increases.

2. Automate Your Savings

Extending on the above, as opposed to trying to carefully remember how much you need to put aside each week or month depending on your saving preference, you can automate this. Out of sight out of mind works well for many when it comes to saving.

Set up automatic transfers coming out of your account into a separate pot to take the process out of your control. Chances are you won’t even notice this come out each month and takes the difficulty out of the process. Again, be realistic with how much you can put aside – do not accrue debt as a result of this.

3. Become a Mindful Spender

Now that you have identified your expenses and understood where your money is going, it is time to cut down on the bigger expenses.

A prime example here is on food. If you are used to eating out or ordering in takeaway, chances are you know money can be saved in this area. With the UK spending more that £1,600 a year on takeaway and restaurant meals, you need to limit your eating out to, example, once a week. Home cooking should save you considerable money.

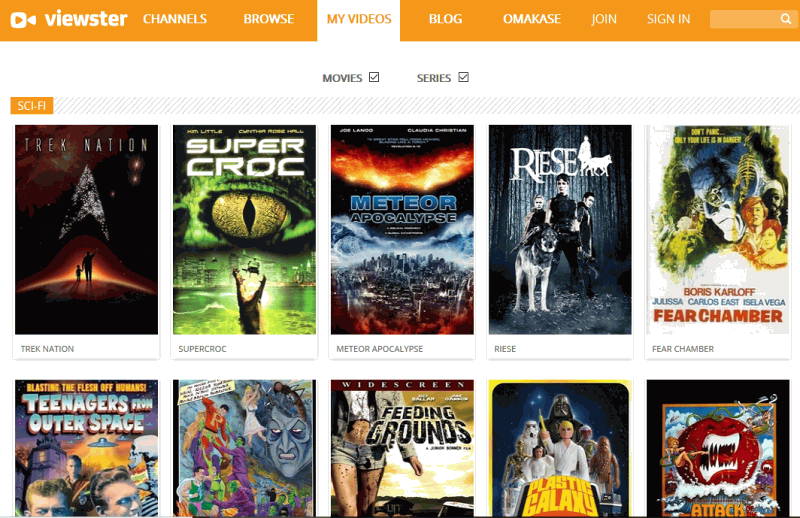

Again, this is just one example, looking at your entertainment and service subscriptions is another common way that people shell out more than required. Critically review your expenses and work out what you feel you truly could not live without. The rest can go.

4. Prioritise Debt

Most people have debt, whether this is controlled or not is another story. The biggest problem people encounter when trying to save money is working out how to tackle their credit card. If you are having difficulty paying this off, often the case where interest rates are high, there are a couple of routes you can take here.

Your first choice is to reach out to your lender and try to negotiate better terms for repayment. Whether this is the minimum payment required or the high level of interest rates, call your bank and set up a meeting to chat.

This is particularly relevant if you feel you will not be able to cover an upcoming payment, chances are they will waive the late fee if you explain your circumstances. Just know what you want before approaching the meeting.

Your other option, should the above not work as intended, is to explore balance transfers. Transferring the debt over to a different lender with more favourable terms is a no brainer.

Many even offer deals that allow you to pay minimal or no interest for 12 to 24 months. This is a great way to plan the amount you will need to pay each month to cover this expense in full by a pre-determined date without having to account for increased interest.

5. Increase Your Income

This point is something you have likely considered already, but if you cannot find any way that your current income will cover necessary expenses, you will need to increase your income.

There are various ways to approach this. Short term, you can sell items you don’t need, but this is a temporary solution. Getting a part time job to go alongside your existing job should allow you to cover your higher expenses. This doesn’t have to be time consuming either and depends on the level of additional income required. This could just be a ‘side hustle’, like walking a neighbour’s dog to online tutoring.

You could also negotiate the salary at your current employers, or simply look elsewhere for higher paying jobs. Be careful here not to burn existing bridges, as some income is better than none.

As your income grows and you develop some stability, you could even look at making investments to grow your money passively whilst you work. Only commit to this when you have established a solid foundation.

Following the above, we hope you found a few ways to tackle financial problems when on a lower wage. There are a range of financial planning tools, such as apps or software, to specialists that can help you, tailoring advice to your needs.

Add Comment